(Bloomberg) -- US job openings remained elevated in November, highlighting how a resilient labor market is likely to keep the Federal Reserve tilted toward more restrictive policy in the months ahead.

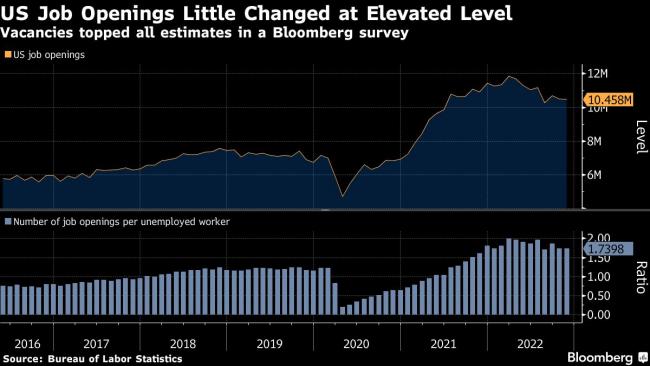

The number of available positions ticked down to 10.46 million from 10.51 million a month earlier, the Labor Department’s Job Openings and Labor Turnover Survey, or JOLTS, showed Wednesday. The figure was higher than all estimates in a Bloomberg survey of economists.

The figures point to a still-tight jobs market where employers’ demand for workers far outstrips supply. Hiring, while moderating, remains solid and layoffs low. The persistent imbalance continues to put upward pressure on wages and has been highlighted by Fed Chair Jerome Powell as key to the path of inflation.

The elevated number of openings paired with consistently robust payroll advances is likely to reinforce expectations that the Fed will keep rates restrictive for quite some time to quell inflation and ensure price growth is on a sustained downward trend. Investors will parse the minutes of the policy makers December meeting, out later Wednesday, to help shed light on the central bank’s outlook.

The S&P 500 fell after the report and Treasury yields rose.

Separate data Wednesday showed US manufacturing activity contracted for a second month in December, helping to further tame price pressures.

Fed Ratio

Job openings increased in professional and business services as well as manufacturing. Meantime, vacancies declined in finance and insurance and the federal government.

The ratio of openings to unemployed people remained elevated at 1.7, little changed from October. It was around 1.2 before the pandemic.

Fed officials watch this ratio closely and have pointed to the elevated number of job openings as a reason why the central bank may be able to cool the labor market — and therefore inflation — without an ensuing surge in unemployment.

That said, many economists expect Fed tightening to push the economy into recession within the next year and for unemployment to rise to some degree.

The JOLTS report showed moderation in hiring in some sectors, including industries like accommodation and food services, construction and retail trade. Meantime, layoffs ticked lower.

The so-called quits rate, which measures voluntary job leavers as a share of total employment, rose for the first time since February to 2.7%, or 4.2 million Americans.

The data precede Friday’s monthly jobs report, which is currently forecast to show employers added 200,000 payrolls in December. Economists are expecting the unemployment rate to hold at 3.7% and for average hourly earnings to moderate somewhat.

EUR/USD

1.0658

-0.0008 (-0.07%)

Summary

↑ SellMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (2)

Sell (3)

EUR/USD

1.0658

-0.0008 (-0.07%)

Summary

↑ SellMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (2)

Sell (3)

GBP/USD

1.2475

-0.0015 (-0.12%)

Summary

↑ SellMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (0)

Sell (10)

USD/JPY

157.91

+0.12 (+0.07%)

Summary

↑ BuyMoving Avg:

Buy (12)

Sell (0)

Indicators:

Buy (9)

Sell (0)

AUD/USD

0.6469

-0.0003 (-0.05%)

Summary

NeutralMoving Avg:

Buy (10)

Sell (2)

Indicators:

Buy (2)

Sell (3)

USD/CAD

1.3780

+0.0003 (+0.03%)

Summary

↑ BuyMoving Avg:

Buy (12)

Sell (0)

Indicators:

Buy (7)

Sell (0)

EUR/JPY

168.32

+0.10 (+0.06%)

Summary

↑ BuyMoving Avg:

Buy (12)

Sell (0)

Indicators:

Buy (9)

Sell (0)

EUR/CHF

0.9808

+0.0001 (+0.01%)

Summary

NeutralMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (3)

Sell (2)

Gold Futures

2,295.80

-7.10 (-0.31%)

Summary

↑ SellMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (0)

Sell (9)

Silver Futures

26.677

+0.023 (+0.09%)

Summary

↑ SellMoving Avg:

Buy (2)

Sell (10)

Indicators:

Buy (0)

Sell (9)

Copper Futures

4.5305

-0.0105 (-0.23%)

Summary

↑ BuyMoving Avg:

Buy (10)

Sell (2)

Indicators:

Buy (8)

Sell (1)

Crude Oil WTI Futures

81.14

-0.79 (-0.96%)

Summary

↑ SellMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (1)

Sell (7)

Brent Oil Futures

85.62

-0.71 (-0.82%)

Summary

↑ SellMoving Avg:

Buy (1)

Sell (11)

Indicators:

Buy (1)

Sell (7)

Natural Gas Futures

1.946

-0.009 (-0.46%)

Summary

↑ SellMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (0)

Sell (5)

US Coffee C Futures

213.73

-13.77 (-6.05%)

Summary

↑ SellMoving Avg:

Buy (3)

Sell (9)

Indicators:

Buy (0)

Sell (10)

Euro Stoxx 50

4,920.55

-60.54 (-1.22%)

Summary

↑ SellMoving Avg:

Buy (4)

Sell (8)

Indicators:

Buy (1)

Sell (7)

S&P 500

5,035.69

-80.48 (-1.57%)

Summary

↑ SellMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (0)

Sell (7)

DAX

17,921.95

-196.37 (-1.08%)

Summary

↑ SellMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (1)

Sell (6)

FTSE 100

8,144.13

-2.90 (-0.04%)

Summary

SellMoving Avg:

Buy (5)

Sell (7)

Indicators:

Buy (2)

Sell (4)

Hang Seng

17,763.03

+16.12 (+0.09%)

Summary

↑ SellMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (1)

Sell (6)

US Small Cap 2000

1,973.05

-42.98 (-2.13%)

Summary

↑ SellMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (0)

Sell (7)

IBEX 35

10,854.40

-246.40 (-2.22%)

Summary

NeutralMoving Avg:

Buy (6)

Sell (6)

Indicators:

Buy (3)

Sell (3)

BASF SE NA O.N.

49.155

+0.100 (+0.20%)

Summary

↑ SellMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (1)

Sell (7)

Bayer AG NA

27.35

-0.24 (-0.87%)

Summary

↑ SellMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (0)

Sell (8)

Allianz SE VNA O.N.

266.60

+0.30 (+0.11%)

Summary

↑ SellMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (3)

Sell (5)

Adidas AG

226.40

-5.90 (-2.54%)

Summary

↑ SellMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (2)

Sell (7)

Deutsche Lufthansa AG

6.714

-0.028 (-0.42%)

Summary

NeutralMoving Avg:

Buy (3)

Sell (9)

Indicators:

Buy (9)

Sell (1)

Siemens AG Class N

175.90

-1.74 (-0.98%)

Summary

↑ SellMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (0)

Sell (9)

Deutsche Bank AG

15.010

-0.094 (-0.62%)

Summary

NeutralMoving Avg:

Buy (4)

Sell (8)

Indicators:

Buy (6)

Sell (2)

| EUR/USD | 1.0658 | ↑ Sell | |||

| GBP/USD | 1.2475 | ↑ Sell | |||

| USD/JPY | 157.91 | ↑ Buy | |||

| AUD/USD | 0.6469 | Neutral | |||

| USD/CAD | 1.3780 | ↑ Buy | |||

| EUR/JPY | 168.32 | ↑ Buy | |||

| EUR/CHF | 0.9808 | Neutral |

| Gold | 2,295.80 | ↑ Sell | |||

| Silver | 26.677 | ↑ Sell | |||

| Copper | 4.5305 | ↑ Buy | |||

| Crude Oil WTI | 81.14 | ↑ Sell | |||

| Brent Oil | 85.62 | ↑ Sell | |||

| Natural Gas | 1.946 | ↑ Sell | |||

| US Coffee C | 213.73 | ↑ Sell |

| Euro Stoxx 50 | 4,920.55 | ↑ Sell | |||

| S&P 500 | 5,035.69 | ↑ Sell | |||

| DAX | 17,921.95 | ↑ Sell | |||

| FTSE 100 | 8,144.13 | Sell | |||

| Hang Seng | 17,763.03 | ↑ Sell | |||

| Small Cap 2000 | 1,973.05 | ↑ Sell | |||

| IBEX 35 | 10,854.40 | Neutral |

| BASF | 49.155 | ↑ Sell | |||

| Bayer | 27.35 | ↑ Sell | |||

| Allianz | 266.60 | ↑ Sell | |||

| Adidas | 226.40 | ↑ Sell | |||

| Lufthansa | 6.714 | Neutral | |||

| Siemens AG | 175.90 | ↑ Sell | |||

| Deutsche Bank AG | 15.010 | Neutral |

| Mua/Bán 1 chỉ SJC # So hôm qua # Chênh TG | |

|---|---|

| SJC Eximbank | 8,300/ 8,500 (8,300/ 8,500) # 1,298 |

| SJC 1L, 10L, 1KG | 8,300/ 8,520 (0/ 0) # 1,510 |

| SJC 1c, 2c, 5c | 7,380/ 7,550 (0/ 0) # 540 |

| SJC 0,5c | 7,380/ 7,560 (0/ 0) # 550 |

| SJC 99,99% | 7,370/ 7,470 (0/ 0) # 460 |

| SJC 99% | 7,196/ 7,396 (0/ 0) # 386 |

| Cập nhật 01-05-2024 10:45:19 | |

| Xem lịch sử giá vàng SJC: nhấn đây! | |

| ↀ Giá vàng thế giới | ||

|---|---|---|

| $2,285.72 | -47.5 | -2.04% |

| ʘ Giá bán lẻ xăng dầu | ||

|---|---|---|

| Sản phẩm | Vùng 1 | Vùng 2 |

| RON 95-V | 25.440 | 25.940 |

| RON 95-III | 24.910 | 25.400 |

| E5 RON 92-II | 23.910 | 24.380 |

| DO 0.05S | 20.710 | 21.120 |

| DO 0,001S-V | 21.320 | 21.740 |

| Dầu hỏa 2-K | 20.680 | 21.090 |

| ↂ Giá dầu thô thế giới | |||

|---|---|---|---|

| WTI | $80.83 | +3.39 | 0.04% |

| Brent | $85.50 | +3.86 | 0.05% |

| $ Tỷ giá Vietcombank | ||

|---|---|---|

| Ngoại tệ | Mua vào | Bán ra |

| USD | 25.088,00 | 25.458,00 |

| EUR | 26.475,36 | 27.949,19 |

| GBP | 30.873,52 | 32.211,36 |

| JPY | 156,74 | 166,02 |

| KRW | 15,92 | 19,31 |

| Cập nhật lúc 10:45:15 01/05/2024 Xem bảng tỷ giá hối đoái | ||