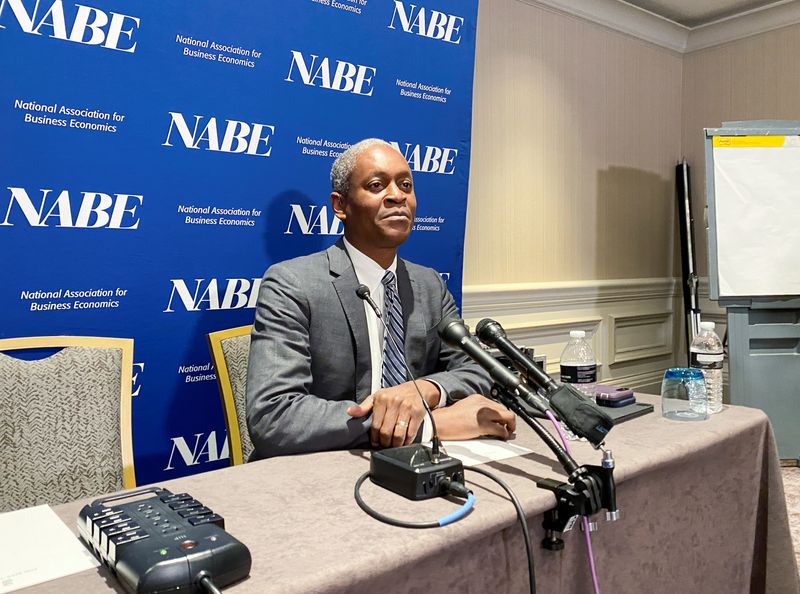

© Reuters. U.S. Atlanta Federal Reserve Bank President Raphael Bostic speaks to reporters at the National Association of Business Economics' annual policy meeting in Washington, U.S. March 21, 2022. REUTERS/Ann Saphir

© Reuters. U.S. Atlanta Federal Reserve Bank President Raphael Bostic speaks to reporters at the National Association of Business Economics' annual policy meeting in Washington, U.S. March 21, 2022. REUTERS/Ann Saphir

By Lindsay (NYSE:LNN) Dunsmuir

(Reuters) - The latest U.S. jobs figures are another sign that the economy is gradually slowing and should that continue the Federal Reserve can step down to a quarter percentage point interest rate hike at its next policy meeting, Atlanta Fed President Raphael Bostic said on Friday.

"Today I would be comfortable with either a 50 or a 25 (basis point increase). If I start to hear signs that the labor market is starting to ease a bit in terms of its tightness then I might lean more into the 25 basis point position," Bostic told broadcaster CNBC.

The economy maintained a strong pace of job growth in December, government data showed earlier on Friday, with the unemployment rate falling to 3.5%, but a moderation in wage gains heartened investors as the Fed aims to bring down high inflation without sparking mass layoffs.

Bostic said the data did not change his outlook and reiterated the central bank would need to raise rates further and hold them at that peak, in his forecast, until "well" into 2024 to tame inflation, which remains well above the Fed's 2% target.

"I've been looking for the economy to continually slow from the strong position it was at in the summer time," Bostic said. "This is just a next step in that...it's going incrementally...because of that we got to stay the course, inflation is too high, we need to reduce those imbalances."

He also cautioned against placing too much emphasis on the pace of wage growth, saying they were "not driving the dynamic" on inflation but still need careful monitoring.

Officials at the Fed, which raised borrowing costs last year at the fastest rate in 40 years to quell the pace of price increases, are eyeing a stopping point in its current tightening cycle this spring.

Their median forecast is for interest rates to peak at around 5.1%. The Fed's main policy rate currently sits in a target range of 4.25% to 4.50%. In his interview, Bostic said that he see rates topping out at between 5.00% and 5.25%.

Traders of futures tied to the Federal Reserve's policy rate priced in a stronger chance that the Fed would raise rates by a quarter percentage point instead of a half point move at the conclusion of its next policy meeting on Feb. 1 following the unemployment data.

Bostic said he does not see a recession this year and revealed he sees the unemployment rate rising to only 4% by year end, lower than many of his rate-setting colleagues.

EUR/USD

1.0658

-0.0008 (-0.07%)

Summary

↑ SellMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (2)

Sell (3)

EUR/USD

1.0658

-0.0008 (-0.07%)

Summary

↑ SellMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (2)

Sell (3)

GBP/USD

1.2475

-0.0015 (-0.12%)

Summary

↑ SellMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (0)

Sell (10)

USD/JPY

157.91

+0.12 (+0.07%)

Summary

↑ BuyMoving Avg:

Buy (12)

Sell (0)

Indicators:

Buy (9)

Sell (0)

AUD/USD

0.6469

-0.0003 (-0.05%)

Summary

NeutralMoving Avg:

Buy (10)

Sell (2)

Indicators:

Buy (2)

Sell (3)

USD/CAD

1.3780

+0.0003 (+0.03%)

Summary

↑ BuyMoving Avg:

Buy (12)

Sell (0)

Indicators:

Buy (7)

Sell (0)

EUR/JPY

168.32

+0.10 (+0.06%)

Summary

↑ BuyMoving Avg:

Buy (12)

Sell (0)

Indicators:

Buy (9)

Sell (0)

EUR/CHF

0.9808

+0.0001 (+0.01%)

Summary

NeutralMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (3)

Sell (2)

Gold Futures

2,295.80

-7.10 (-0.31%)

Summary

↑ SellMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (0)

Sell (9)

Silver Futures

26.677

+0.023 (+0.09%)

Summary

↑ SellMoving Avg:

Buy (2)

Sell (10)

Indicators:

Buy (0)

Sell (9)

Copper Futures

4.5305

-0.0105 (-0.23%)

Summary

↑ BuyMoving Avg:

Buy (10)

Sell (2)

Indicators:

Buy (8)

Sell (1)

Crude Oil WTI Futures

81.14

-0.79 (-0.96%)

Summary

↑ SellMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (1)

Sell (7)

Brent Oil Futures

85.62

-0.71 (-0.82%)

Summary

↑ SellMoving Avg:

Buy (1)

Sell (11)

Indicators:

Buy (1)

Sell (7)

Natural Gas Futures

1.946

-0.009 (-0.46%)

Summary

↑ SellMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (0)

Sell (5)

US Coffee C Futures

213.73

-13.77 (-6.05%)

Summary

↑ SellMoving Avg:

Buy (3)

Sell (9)

Indicators:

Buy (0)

Sell (10)

Euro Stoxx 50

4,920.55

-60.54 (-1.22%)

Summary

↑ SellMoving Avg:

Buy (4)

Sell (8)

Indicators:

Buy (1)

Sell (7)

S&P 500

5,035.69

-80.48 (-1.57%)

Summary

↑ SellMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (0)

Sell (7)

DAX

17,921.95

-196.37 (-1.08%)

Summary

↑ SellMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (1)

Sell (6)

FTSE 100

8,144.13

-2.90 (-0.04%)

Summary

SellMoving Avg:

Buy (5)

Sell (7)

Indicators:

Buy (2)

Sell (4)

Hang Seng

17,763.03

+16.12 (+0.09%)

Summary

↑ SellMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (1)

Sell (6)

US Small Cap 2000

1,973.05

-42.98 (-2.13%)

Summary

↑ SellMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (0)

Sell (7)

IBEX 35

10,854.40

-246.40 (-2.22%)

Summary

NeutralMoving Avg:

Buy (6)

Sell (6)

Indicators:

Buy (3)

Sell (3)

BASF SE NA O.N.

49.155

+0.100 (+0.20%)

Summary

↑ SellMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (1)

Sell (7)

Bayer AG NA

27.35

-0.24 (-0.87%)

Summary

↑ SellMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (0)

Sell (8)

Allianz SE VNA O.N.

266.60

+0.30 (+0.11%)

Summary

↑ SellMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (3)

Sell (5)

Adidas AG

226.40

-5.90 (-2.54%)

Summary

↑ SellMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (2)

Sell (7)

Deutsche Lufthansa AG

6.714

-0.028 (-0.42%)

Summary

NeutralMoving Avg:

Buy (3)

Sell (9)

Indicators:

Buy (9)

Sell (1)

Siemens AG Class N

175.90

-1.74 (-0.98%)

Summary

↑ SellMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (0)

Sell (9)

Deutsche Bank AG

15.010

-0.094 (-0.62%)

Summary

NeutralMoving Avg:

Buy (4)

Sell (8)

Indicators:

Buy (6)

Sell (2)

| EUR/USD | 1.0658 | ↑ Sell | |||

| GBP/USD | 1.2475 | ↑ Sell | |||

| USD/JPY | 157.91 | ↑ Buy | |||

| AUD/USD | 0.6469 | Neutral | |||

| USD/CAD | 1.3780 | ↑ Buy | |||

| EUR/JPY | 168.32 | ↑ Buy | |||

| EUR/CHF | 0.9808 | Neutral |

| Gold | 2,295.80 | ↑ Sell | |||

| Silver | 26.677 | ↑ Sell | |||

| Copper | 4.5305 | ↑ Buy | |||

| Crude Oil WTI | 81.14 | ↑ Sell | |||

| Brent Oil | 85.62 | ↑ Sell | |||

| Natural Gas | 1.946 | ↑ Sell | |||

| US Coffee C | 213.73 | ↑ Sell |

| Euro Stoxx 50 | 4,920.55 | ↑ Sell | |||

| S&P 500 | 5,035.69 | ↑ Sell | |||

| DAX | 17,921.95 | ↑ Sell | |||

| FTSE 100 | 8,144.13 | Sell | |||

| Hang Seng | 17,763.03 | ↑ Sell | |||

| Small Cap 2000 | 1,973.05 | ↑ Sell | |||

| IBEX 35 | 10,854.40 | Neutral |

| BASF | 49.155 | ↑ Sell | |||

| Bayer | 27.35 | ↑ Sell | |||

| Allianz | 266.60 | ↑ Sell | |||

| Adidas | 226.40 | ↑ Sell | |||

| Lufthansa | 6.714 | Neutral | |||

| Siemens AG | 175.90 | ↑ Sell | |||

| Deutsche Bank AG | 15.010 | Neutral |

| Mua/Bán 1 chỉ SJC # So hôm qua # Chênh TG | |

|---|---|

| SJC Eximbank | 8,300/ 8,500 (8,300/ 8,500) # 1,298 |

| SJC 1L, 10L, 1KG | 8,300/ 8,520 (0/ 0) # 1,510 |

| SJC 1c, 2c, 5c | 7,380/ 7,550 (0/ 0) # 540 |

| SJC 0,5c | 7,380/ 7,560 (0/ 0) # 550 |

| SJC 99,99% | 7,370/ 7,470 (0/ 0) # 460 |

| SJC 99% | 7,196/ 7,396 (0/ 0) # 386 |

| Cập nhật 01-05-2024 10:45:19 | |

| Xem lịch sử giá vàng SJC: nhấn đây! | |

| ↀ Giá vàng thế giới | ||

|---|---|---|

| $2,285.72 | -47.5 | -2.04% |

| ʘ Giá bán lẻ xăng dầu | ||

|---|---|---|

| Sản phẩm | Vùng 1 | Vùng 2 |

| RON 95-V | 25.440 | 25.940 |

| RON 95-III | 24.910 | 25.400 |

| E5 RON 92-II | 23.910 | 24.380 |

| DO 0.05S | 20.710 | 21.120 |

| DO 0,001S-V | 21.320 | 21.740 |

| Dầu hỏa 2-K | 20.680 | 21.090 |

| ↂ Giá dầu thô thế giới | |||

|---|---|---|---|

| WTI | $80.83 | +3.39 | 0.04% |

| Brent | $85.50 | +3.86 | 0.05% |

| $ Tỷ giá Vietcombank | ||

|---|---|---|

| Ngoại tệ | Mua vào | Bán ra |

| USD | 25.088,00 | 25.458,00 |

| EUR | 26.475,36 | 27.949,19 |

| GBP | 30.873,52 | 32.211,36 |

| JPY | 156,74 | 166,02 |

| KRW | 15,92 | 19,31 |

| Cập nhật lúc 10:45:15 01/05/2024 Xem bảng tỷ giá hối đoái | ||