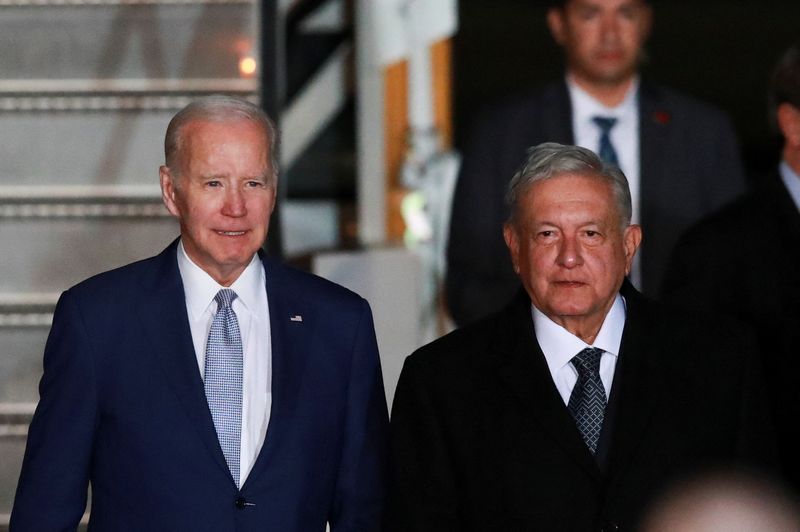

© Reuters. U.S. President Joe Biden walks with Mexico's President Andres Manuel Lopez Obrador as he arrives at the Felipe Angeles International Airport, to attend the North American Leaders' Summit, in Santa Lucia, Mexico January 8, 2023. REUTERS/Henry Romero

© Reuters. U.S. President Joe Biden walks with Mexico's President Andres Manuel Lopez Obrador as he arrives at the Felipe Angeles International Airport, to attend the North American Leaders' Summit, in Santa Lucia, Mexico January 8, 2023. REUTERS/Henry Romero By Dave Graham and Jarrett Renshaw

MEXICO CITY (Reuters) -U.S. President Joe Biden and his Mexican counterpart discussed stronger economic ties, fighting the illegal drug trade, and approaches to curbing illegal migration at a meeting in Mexico City on Monday, the White House said in a statement.

Biden and Mexican President Andres Manuel Lopez Obrador also discussed incentives to promote investment in semiconductor manufacturing along the border in the bilateral meeting, the White House said.

"There are unmatched conditions to start a new policy of economic and social integration in our continent," Lopez Obrador said at the start of the meeting, urging Biden to invest in the region.

Lopez Obrador is hosting Biden and Canadian Prime Minister Justin Trudeau from Monday to Wednesday for the first summit between the three since late 2021.

The talk of closer partnership comes even as disagreements persist over Lopez Obrador's nationalist energy policies, which led to the launch of a formal trade complaint in July by Washington and Ottawa.

Lopez Obrador said a trade agreement has proven to be a valuable instrument but that there was continuous growth in its Pacific ports with goods from Asia, signaling the countries remain dependent on Asian industrial production.

"Couldn't we produce in America what we consume? Of course, it is a matter of definition and joint planning of our future development," he said during a meeting with Biden.

Since the COVID-19 pandemic battered supply chains, policymakers have stepped up calls for firms to relocate business from Asia to beef up the economies covered by the United States-Mexico-Canada regional trade agreement.

The two leaders also reaffirmed their commitment to use "innovative approaches" to reduce irregular migration, after the Biden Administration recently introduced a policy to expel back to Mexico migrants from Cuba, Haiti and Nicaragua who cross the border illegally.

Mexico has urged the United States to commit funds to Central America and southern Mexico to boost development and stem migration from one of the poorest regions in the hemisphere, and to make it easier for migrants to get U.S. jobs.

The leaders discussed more cooperation to prosecute drug traffickers and disrupt supplies of chemicals used to make fentanyl, the White House said, with the synthetic opioid blamed for thousands of U.S. deaths.

Two Mexican officials, speaking on condition of anonymity, told Reuters earlier on Monday the plan would in essence involve Mexico reducing the fentanyl smuggled across the border in exchange for the United States' bringing down the number of guns being trafficked into Mexico.

Mexico last week arrested a prominent cartel leader, Ovidio Guzman, who is wanted in the United States. Weaponry used by Guzman's gang had come into the country from U.S. border states, one of the Mexican officials said.

DOMESTIC POLITICS

Despite the talk of strengthening ties, tensions remain. Lopez Obrador has alarmed the United States with a plan to prohibit imports of genetically-modified corn, though Mexico agreed to delay the ban until 2025. The three trading partners have also been at loggerheads over auto rules of origin.

"Trade tensions over automobiles, customs rules, genetically-modified corn and Mexico's energy policies are already high and could sharpen," said Jake Colvin, president of the Washington-based National Foreign Trade Council.

"To create a North American corridor to outcompete China, the United States, Canada and Mexico need to be on the same economic page," he added.

Lopez Obrador, a combative leftist, says his energy policy is a matter of national sovereignty, arguing that past governments skewed the market to favor private interests.

The United States and Canada say their firms have been disadvantaged by Lopez Obrador's campaign to give control of the market to his cash-strapped state energy companies, and the row has taken the shine off the outlook for investment.

Trudeau told Reuters on Friday he would make the case that resolving the energy dispute would help bring more foreign capital to Mexico, and was confident of making progress.

As part of that drive, Lopez Obrador - who in June snubbed Biden's invitation to the Summit of the Americas in Los Angeles in protest at his exclusion of the leaders of Cuba, Venezuela and Nicaragua - wants to discuss his plan to boost solar power in northern Mexico and secure U.S. financial support for it.

Christopher Landau, U.S. ambassador to Mexico under former President Donald Trump, said domestic politics meant finding compromises on energy, as well as migration would be difficult.

"There's no obvious deal that satisfies all of their domestic interests," he said, "but I think it's in all their domestic interest to say they get along."

EUR/USD

1.0658

-0.0008 (-0.07%)

Summary

↑ SellMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (2)

Sell (3)

EUR/USD

1.0658

-0.0008 (-0.07%)

Summary

↑ SellMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (2)

Sell (3)

GBP/USD

1.2475

-0.0015 (-0.12%)

Summary

↑ SellMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (0)

Sell (10)

USD/JPY

157.91

+0.12 (+0.07%)

Summary

↑ BuyMoving Avg:

Buy (12)

Sell (0)

Indicators:

Buy (9)

Sell (0)

AUD/USD

0.6469

-0.0003 (-0.05%)

Summary

NeutralMoving Avg:

Buy (10)

Sell (2)

Indicators:

Buy (2)

Sell (3)

USD/CAD

1.3780

+0.0003 (+0.03%)

Summary

↑ BuyMoving Avg:

Buy (12)

Sell (0)

Indicators:

Buy (7)

Sell (0)

EUR/JPY

168.32

+0.10 (+0.06%)

Summary

↑ BuyMoving Avg:

Buy (12)

Sell (0)

Indicators:

Buy (9)

Sell (0)

EUR/CHF

0.9808

+0.0001 (+0.01%)

Summary

NeutralMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (3)

Sell (2)

Gold Futures

2,295.80

-7.10 (-0.31%)

Summary

↑ SellMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (0)

Sell (9)

Silver Futures

26.677

+0.023 (+0.09%)

Summary

↑ SellMoving Avg:

Buy (2)

Sell (10)

Indicators:

Buy (0)

Sell (9)

Copper Futures

4.5305

-0.0105 (-0.23%)

Summary

↑ BuyMoving Avg:

Buy (10)

Sell (2)

Indicators:

Buy (8)

Sell (1)

Crude Oil WTI Futures

81.14

-0.79 (-0.96%)

Summary

↑ SellMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (1)

Sell (7)

Brent Oil Futures

85.62

-0.71 (-0.82%)

Summary

↑ SellMoving Avg:

Buy (1)

Sell (11)

Indicators:

Buy (1)

Sell (7)

Natural Gas Futures

1.946

-0.009 (-0.46%)

Summary

↑ SellMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (0)

Sell (5)

US Coffee C Futures

213.73

-13.77 (-6.05%)

Summary

↑ SellMoving Avg:

Buy (3)

Sell (9)

Indicators:

Buy (0)

Sell (10)

Euro Stoxx 50

4,920.55

-60.54 (-1.22%)

Summary

↑ SellMoving Avg:

Buy (4)

Sell (8)

Indicators:

Buy (1)

Sell (7)

S&P 500

5,035.69

-80.48 (-1.57%)

Summary

↑ SellMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (0)

Sell (7)

DAX

17,921.95

-196.37 (-1.08%)

Summary

↑ SellMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (1)

Sell (6)

FTSE 100

8,144.13

-2.90 (-0.04%)

Summary

SellMoving Avg:

Buy (5)

Sell (7)

Indicators:

Buy (2)

Sell (4)

Hang Seng

17,763.03

+16.12 (+0.09%)

Summary

↑ SellMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (1)

Sell (6)

US Small Cap 2000

1,973.05

-42.98 (-2.13%)

Summary

↑ SellMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (0)

Sell (7)

IBEX 35

10,854.40

-246.40 (-2.22%)

Summary

NeutralMoving Avg:

Buy (6)

Sell (6)

Indicators:

Buy (3)

Sell (3)

BASF SE NA O.N.

49.155

+0.100 (+0.20%)

Summary

↑ SellMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (1)

Sell (7)

Bayer AG NA

27.35

-0.24 (-0.87%)

Summary

↑ SellMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (0)

Sell (8)

Allianz SE VNA O.N.

266.60

+0.30 (+0.11%)

Summary

↑ SellMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (3)

Sell (5)

Adidas AG

226.40

-5.90 (-2.54%)

Summary

↑ SellMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (2)

Sell (7)

Deutsche Lufthansa AG

6.714

-0.028 (-0.42%)

Summary

NeutralMoving Avg:

Buy (3)

Sell (9)

Indicators:

Buy (9)

Sell (1)

Siemens AG Class N

175.90

-1.74 (-0.98%)

Summary

↑ SellMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (0)

Sell (9)

Deutsche Bank AG

15.010

-0.094 (-0.62%)

Summary

NeutralMoving Avg:

Buy (4)

Sell (8)

Indicators:

Buy (6)

Sell (2)

| EUR/USD | 1.0658 | ↑ Sell | |||

| GBP/USD | 1.2475 | ↑ Sell | |||

| USD/JPY | 157.91 | ↑ Buy | |||

| AUD/USD | 0.6469 | Neutral | |||

| USD/CAD | 1.3780 | ↑ Buy | |||

| EUR/JPY | 168.32 | ↑ Buy | |||

| EUR/CHF | 0.9808 | Neutral |

| Gold | 2,295.80 | ↑ Sell | |||

| Silver | 26.677 | ↑ Sell | |||

| Copper | 4.5305 | ↑ Buy | |||

| Crude Oil WTI | 81.14 | ↑ Sell | |||

| Brent Oil | 85.62 | ↑ Sell | |||

| Natural Gas | 1.946 | ↑ Sell | |||

| US Coffee C | 213.73 | ↑ Sell |

| Euro Stoxx 50 | 4,920.55 | ↑ Sell | |||

| S&P 500 | 5,035.69 | ↑ Sell | |||

| DAX | 17,921.95 | ↑ Sell | |||

| FTSE 100 | 8,144.13 | Sell | |||

| Hang Seng | 17,763.03 | ↑ Sell | |||

| Small Cap 2000 | 1,973.05 | ↑ Sell | |||

| IBEX 35 | 10,854.40 | Neutral |

| BASF | 49.155 | ↑ Sell | |||

| Bayer | 27.35 | ↑ Sell | |||

| Allianz | 266.60 | ↑ Sell | |||

| Adidas | 226.40 | ↑ Sell | |||

| Lufthansa | 6.714 | Neutral | |||

| Siemens AG | 175.90 | ↑ Sell | |||

| Deutsche Bank AG | 15.010 | Neutral |

| Mua/Bán 1 chỉ SJC # So hôm qua # Chênh TG | |

|---|---|

| SJC Eximbank | 8,300/ 8,500 (8,300/ 8,500) # 1,298 |

| SJC 1L, 10L, 1KG | 8,300/ 8,520 (0/ 0) # 1,510 |

| SJC 1c, 2c, 5c | 7,380/ 7,550 (0/ 0) # 540 |

| SJC 0,5c | 7,380/ 7,560 (0/ 0) # 550 |

| SJC 99,99% | 7,370/ 7,470 (0/ 0) # 460 |

| SJC 99% | 7,196/ 7,396 (0/ 0) # 386 |

| Cập nhật 01-05-2024 10:45:19 | |

| Xem lịch sử giá vàng SJC: nhấn đây! | |

| ↀ Giá vàng thế giới | ||

|---|---|---|

| $2,285.72 | -47.5 | -2.04% |

| ʘ Giá bán lẻ xăng dầu | ||

|---|---|---|

| Sản phẩm | Vùng 1 | Vùng 2 |

| RON 95-V | 25.440 | 25.940 |

| RON 95-III | 24.910 | 25.400 |

| E5 RON 92-II | 23.910 | 24.380 |

| DO 0.05S | 20.710 | 21.120 |

| DO 0,001S-V | 21.320 | 21.740 |

| Dầu hỏa 2-K | 20.680 | 21.090 |

| ↂ Giá dầu thô thế giới | |||

|---|---|---|---|

| WTI | $80.83 | +3.39 | 0.04% |

| Brent | $85.50 | +3.86 | 0.05% |

| $ Tỷ giá Vietcombank | ||

|---|---|---|

| Ngoại tệ | Mua vào | Bán ra |

| USD | 25.088,00 | 25.458,00 |

| EUR | 26.475,36 | 27.949,19 |

| GBP | 30.873,52 | 32.211,36 |

| JPY | 156,74 | 166,02 |

| KRW | 15,92 | 19,31 |

| Cập nhật lúc 10:45:15 01/05/2024 Xem bảng tỷ giá hối đoái | ||