(Bloomberg) -- Federal Reserve Bank of San Francisco President Mary Daly said 4.75% to 5.25% was a “reasonable” range for where policymakers could lift interest rates and then go on hold.

“Somewhere between 4.75 and 5.25 seems a reasonable place to think about as we go into the next meeting,” Daly said in a Wednesday interview on CNBC. “And so that does put it in the line of sight that we would get to a point where we would raise and hold.”

US central bankers have raised rates by 75 basis points at four consecutive meetings to curb the highest inflation in four decades. Their benchmark federal funds rate is now in a range of 3.75%-4%.

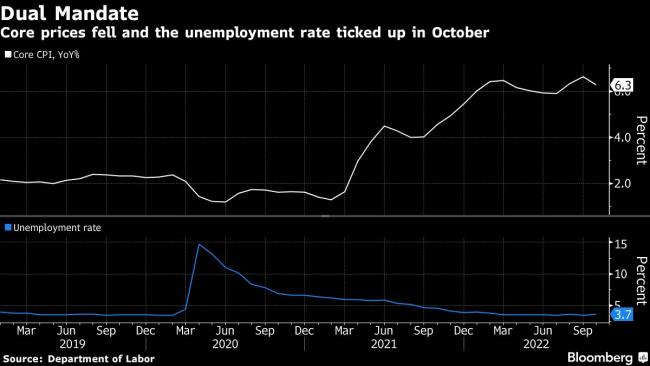

Some Fed officials have said it may be time to start moderating the pace of rate increases following a report last week that showed a slowdown in consumer inflation.

Daly said that while the strategy is to raise rates and then hold for a time, that did not mean they were close to ending their tightening campaign.

“Pausing is off the table right now, it’s not even part of the discussion,” she said. “Right now the discussion is, rightly, in slowing the pace.”

Daly also said officials are turning their focus to how high the benchmark interest rate will ultimately need to rise to in order to be “sufficiently restrictive.”

Investors expect the central bank to moderate its next rate hike to 50 basis points when officials meet Dec. 13-14 and see rates peaking around 4.9% by mid 2023.

A softening in core consumer goods inflation in last week’s consumer price index report was positive news, Daly said.

‘Positive Signs’

“One month of data does not a victory make, but those were some positive signs,” Daly said. “These things getting better are encouraging, as is a slower labor market. But we need to get more of that to be sure and confident that inflation will come down to our price stability goal in any reasonable amount of time.”

The unemployment rate may need to rise to 4.5-5% in order to bring down wage growth and inflation, Daly said. The jobless rate rose slightly to 3.7% in October but remains near a 50-year low.

New York Fed President John Williams, speaking earlier on Wednesday at a Treasury market conference hosted by his bank, also stressed the necessity to defeat high inflation.

“Restoring price stability is of paramount importance because it is the foundation of sustained economic and financial stability,” he said. “Price stability is not an either/or, it’s a must have.”

(Updates with more Daly comment from ninth paragraph.)

©2022 Bloomberg L.P.

EUR/USD

1.0658

-0.0008 (-0.07%)

Summary

↑ SellMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (2)

Sell (3)

EUR/USD

1.0658

-0.0008 (-0.07%)

Summary

↑ SellMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (2)

Sell (3)

GBP/USD

1.2475

-0.0015 (-0.12%)

Summary

↑ SellMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (0)

Sell (10)

USD/JPY

157.91

+0.12 (+0.07%)

Summary

↑ BuyMoving Avg:

Buy (12)

Sell (0)

Indicators:

Buy (9)

Sell (0)

AUD/USD

0.6469

-0.0003 (-0.05%)

Summary

NeutralMoving Avg:

Buy (10)

Sell (2)

Indicators:

Buy (2)

Sell (3)

USD/CAD

1.3780

+0.0003 (+0.03%)

Summary

↑ BuyMoving Avg:

Buy (12)

Sell (0)

Indicators:

Buy (7)

Sell (0)

EUR/JPY

168.32

+0.10 (+0.06%)

Summary

↑ BuyMoving Avg:

Buy (12)

Sell (0)

Indicators:

Buy (9)

Sell (0)

EUR/CHF

0.9808

+0.0001 (+0.01%)

Summary

NeutralMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (3)

Sell (2)

Gold Futures

2,295.80

-7.10 (-0.31%)

Summary

↑ SellMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (0)

Sell (9)

Silver Futures

26.677

+0.023 (+0.09%)

Summary

↑ SellMoving Avg:

Buy (2)

Sell (10)

Indicators:

Buy (0)

Sell (9)

Copper Futures

4.5305

-0.0105 (-0.23%)

Summary

↑ BuyMoving Avg:

Buy (10)

Sell (2)

Indicators:

Buy (8)

Sell (1)

Crude Oil WTI Futures

81.14

-0.79 (-0.96%)

Summary

↑ SellMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (1)

Sell (7)

Brent Oil Futures

85.62

-0.71 (-0.82%)

Summary

↑ SellMoving Avg:

Buy (1)

Sell (11)

Indicators:

Buy (1)

Sell (7)

Natural Gas Futures

1.946

-0.009 (-0.46%)

Summary

↑ SellMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (0)

Sell (5)

US Coffee C Futures

213.73

-13.77 (-6.05%)

Summary

↑ SellMoving Avg:

Buy (3)

Sell (9)

Indicators:

Buy (0)

Sell (10)

Euro Stoxx 50

4,920.55

-60.54 (-1.22%)

Summary

↑ SellMoving Avg:

Buy (4)

Sell (8)

Indicators:

Buy (1)

Sell (7)

S&P 500

5,035.69

-80.48 (-1.57%)

Summary

↑ SellMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (0)

Sell (7)

DAX

17,921.95

-196.37 (-1.08%)

Summary

↑ SellMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (1)

Sell (6)

FTSE 100

8,144.13

-2.90 (-0.04%)

Summary

SellMoving Avg:

Buy (5)

Sell (7)

Indicators:

Buy (2)

Sell (4)

Hang Seng

17,763.03

+16.12 (+0.09%)

Summary

↑ SellMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (1)

Sell (6)

US Small Cap 2000

1,973.05

-42.98 (-2.13%)

Summary

↑ SellMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (0)

Sell (7)

IBEX 35

10,854.40

-246.40 (-2.22%)

Summary

NeutralMoving Avg:

Buy (6)

Sell (6)

Indicators:

Buy (3)

Sell (3)

BASF SE NA O.N.

49.155

+0.100 (+0.20%)

Summary

↑ SellMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (1)

Sell (7)

Bayer AG NA

27.35

-0.24 (-0.87%)

Summary

↑ SellMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (0)

Sell (8)

Allianz SE VNA O.N.

266.60

+0.30 (+0.11%)

Summary

↑ SellMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (3)

Sell (5)

Adidas AG

226.40

-5.90 (-2.54%)

Summary

↑ SellMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (2)

Sell (7)

Deutsche Lufthansa AG

6.714

-0.028 (-0.42%)

Summary

NeutralMoving Avg:

Buy (3)

Sell (9)

Indicators:

Buy (9)

Sell (1)

Siemens AG Class N

175.90

-1.74 (-0.98%)

Summary

↑ SellMoving Avg:

Buy (0)

Sell (12)

Indicators:

Buy (0)

Sell (9)

Deutsche Bank AG

15.010

-0.094 (-0.62%)

Summary

NeutralMoving Avg:

Buy (4)

Sell (8)

Indicators:

Buy (6)

Sell (2)

| EUR/USD | 1.0658 | ↑ Sell | |||

| GBP/USD | 1.2475 | ↑ Sell | |||

| USD/JPY | 157.91 | ↑ Buy | |||

| AUD/USD | 0.6469 | Neutral | |||

| USD/CAD | 1.3780 | ↑ Buy | |||

| EUR/JPY | 168.32 | ↑ Buy | |||

| EUR/CHF | 0.9808 | Neutral |

| Gold | 2,295.80 | ↑ Sell | |||

| Silver | 26.677 | ↑ Sell | |||

| Copper | 4.5305 | ↑ Buy | |||

| Crude Oil WTI | 81.14 | ↑ Sell | |||

| Brent Oil | 85.62 | ↑ Sell | |||

| Natural Gas | 1.946 | ↑ Sell | |||

| US Coffee C | 213.73 | ↑ Sell |

| Euro Stoxx 50 | 4,920.55 | ↑ Sell | |||

| S&P 500 | 5,035.69 | ↑ Sell | |||

| DAX | 17,921.95 | ↑ Sell | |||

| FTSE 100 | 8,144.13 | Sell | |||

| Hang Seng | 17,763.03 | ↑ Sell | |||

| Small Cap 2000 | 1,973.05 | ↑ Sell | |||

| IBEX 35 | 10,854.40 | Neutral |

| BASF | 49.155 | ↑ Sell | |||

| Bayer | 27.35 | ↑ Sell | |||

| Allianz | 266.60 | ↑ Sell | |||

| Adidas | 226.40 | ↑ Sell | |||

| Lufthansa | 6.714 | Neutral | |||

| Siemens AG | 175.90 | ↑ Sell | |||

| Deutsche Bank AG | 15.010 | Neutral |

| Mua/Bán 1 chỉ SJC # So hôm qua # Chênh TG | |

|---|---|

| SJC Eximbank | 8,300/ 8,500 (8,300/ 8,500) # 1,298 |

| SJC 1L, 10L, 1KG | 8,300/ 8,520 (0/ 0) # 1,510 |

| SJC 1c, 2c, 5c | 7,380/ 7,550 (0/ 0) # 540 |

| SJC 0,5c | 7,380/ 7,560 (0/ 0) # 550 |

| SJC 99,99% | 7,370/ 7,470 (0/ 0) # 460 |

| SJC 99% | 7,196/ 7,396 (0/ 0) # 386 |

| Cập nhật 01-05-2024 10:45:19 | |

| Xem lịch sử giá vàng SJC: nhấn đây! | |

| ↀ Giá vàng thế giới | ||

|---|---|---|

| $2,285.72 | -47.5 | -2.04% |

| ʘ Giá bán lẻ xăng dầu | ||

|---|---|---|

| Sản phẩm | Vùng 1 | Vùng 2 |

| RON 95-V | 25.440 | 25.940 |

| RON 95-III | 24.910 | 25.400 |

| E5 RON 92-II | 23.910 | 24.380 |

| DO 0.05S | 20.710 | 21.120 |

| DO 0,001S-V | 21.320 | 21.740 |

| Dầu hỏa 2-K | 20.680 | 21.090 |

| ↂ Giá dầu thô thế giới | |||

|---|---|---|---|

| WTI | $80.83 | +3.39 | 0.04% |

| Brent | $85.50 | +3.86 | 0.05% |

| $ Tỷ giá Vietcombank | ||

|---|---|---|

| Ngoại tệ | Mua vào | Bán ra |

| USD | 25.088,00 | 25.458,00 |

| EUR | 26.475,36 | 27.949,19 |

| GBP | 30.873,52 | 32.211,36 |

| JPY | 156,74 | 166,02 |

| KRW | 15,92 | 19,31 |

| Cập nhật lúc 10:45:15 01/05/2024 Xem bảng tỷ giá hối đoái | ||